Top 5 Crypto Staking Platforms for Maximum Return in 2025

Cryptocurrency staking has emerged as one of the most lucrative ways to earn passive income in the blockchain space. With more investors looking to maximize their earnings, the search for the best staking platforms has intensified. In 2025, selecting the right staking platform is crucial to ensure maximum returns, security, and flexibility.

In this article, we will explore the top five crypto staking platforms that offer the highest returns and the best user experience in 2025. If you’re new to crypto staking or want to enhance your knowledge, check out Crypto Made Easy for an in-depth guide on cryptocurrency investing and earning strategies.

1. Binance Staking

Best for: High APY and diverse staking options

Binance remains a dominant force in the crypto space, and its staking platform is no exception. Binance Staking offers both locked and flexible staking options, catering to various investor preferences. Users can stake a wide range of cryptocurrencies, including Ethereum (ETH), Cardano (ADA), and Solana (SOL), to earn high annual percentage yields (APYs).

Key Features:

- Competitive APYs with some assets offering over 10% returns

- Multiple staking options: locked, flexible, and DeFi staking

- No minimum staking requirement

- Easy-to-use interface, ideal for both beginners and experienced users

Why Choose Binance Staking?

With one of the largest liquidity pools and a trusted reputation, Binance ensures seamless staking while providing additional earning opportunities such as dual investment and liquidity farming.

2. Kraken Staking

Best for: Security-conscious investors

Kraken is another industry leader, known for its stringent security measures and user-friendly staking options. Kraken Staking supports a variety of crypto assets and provides instant staking rewards, meaning users can start earning immediately after staking.

Key Features:

- Instant reward payouts twice a week

- Up to 12% APY on select assets

- High security with industry-leading safeguards

- Flexible staking with easy unstaking options

Why Choose Kraken Staking?

If security and regulatory compliance are top priorities, Kraken is an excellent choice. It ensures transparency and reliability, making it ideal for long-term staking strategies.

3. Coinbase Staking

Best for: US-based investors and beginners

Coinbase is one of the most user-friendly crypto exchanges, offering a simple staking experience for beginners. It allows users to stake popular assets like Ethereum (ETH) and Tezos (XTZ) while providing clear staking rewards.

Key Features:

- APYs ranging from 3% to 8%, depending on the asset

- Beginner-friendly interface with guided staking

- Regulatory compliance in the US

- Automatic staking rewards without the need for manual claiming

Why Choose Coinbase Staking?

For those new to staking or residing in the US, Coinbase offers a safe, regulated, and straightforward way to earn passive income on crypto holdings.

4. Lido Finance

Best for: Ethereum staking and DeFi enthusiasts

Lido Finance is a decentralized staking platform that has revolutionized Ethereum staking by allowing users to stake ETH without locking up their funds. Users receive stETH tokens, which represent their staked Ethereum and can be used in DeFi applications.

Key Features:

- Liquid staking, meaning staked assets remain usable

- No minimum ETH requirement (unlike direct staking on Ethereum)

- Supports multiple blockchains, including Solana and Polygon

- High yield with auto-compounding rewards

Why Choose Lido Finance?

Lido Finance is the best choice for Ethereum holders who want maximum flexibility while earning staking rewards and utilizing DeFi opportunities.

5. KuCoin Earn

Best for: Flexible staking and additional earning opportunities

KuCoin Earn provides a versatile staking experience, allowing users to engage in flexible staking, fixed-term staking, and even participate in liquidity mining. It supports various altcoins and often offers promotional high-yield staking events.

Key Features:

- Staking rewards up to 15% APY on select assets

- Multiple staking options, including soft staking (flexible)

- Additional earning opportunities through KuCoin’s lending and savings programs

- Low entry barriers for new investors

Why Choose KuCoin Earn?

KuCoin Earn is perfect for those who prefer a diverse staking portfolio and want to maximize earnings with extra earning features beyond staking.

Final Thoughts: Maximize Your Crypto Staking Profits

With so many staking platforms available, choosing the right one depends on your investment strategy, security preferences, and desired APY. Whether you prefer centralized platforms like Binance and Kraken or decentralized solutions like Lido Finance, the right choice will ensure you get the most out of your crypto holdings.

To dive deeper into crypto investing, staking strategies, and how to maximize your earnings, check out Crypto Made Easy. This book breaks down complex concepts into simple, actionable steps, making it perfect for both beginners and seasoned investors.

For more valuable crypto insights and updates, visit OmaTreasure.com. Stay ahead of the game and make your crypto work for you in 2025!

Top 5 No-KYC Exchanges: Pros and Cons, Expert Tips

Privacy and financial freedom are key concerns in the cryptocurrency space. While centralized exchanges (CEXs) typically require Know Your Customer (KYC) verification, many traders prefer no-KYC exchanges to maintain anonymity and avoid lengthy identity verification processes.

No-KYC exchanges provide users with greater financial autonomy, but they come with both benefits and risks. In this article, we explore the top five no-KYC exchanges, weigh their pros and cons, and share expert tips to help you trade securely. If you’re new to crypto and want to understand how to trade anonymously while maximizing profits, check out Crypto Made Easy, your ultimate guide to navigating the crypto world with ease.

1. Bisq

Best for: Decentralized, peer-to-peer (P2P) trading

Bisq is a fully decentralized exchange that allows users to trade Bitcoin and other cryptocurrencies directly from their wallets without the need for a central authority. It is an open-source platform and does not require KYC verification.

Pros:

- True decentralization and privacy-first approach

- Users retain full control of their funds

- No central server, reducing risks of shutdowns and hacks

- Available worldwide

Cons:

- Lower liquidity compared to major exchanges

- Requires users to be familiar with Tor and P2P trading

- Trading fees can be higher than centralized exchanges

Expert Tip:

To ensure maximum anonymity, always run Bisq over the Tor network and avoid linking personal banking details directly.

2. KuCoin

Best for: Trading a wide range of altcoins

KuCoin is one of the most popular exchanges that allows users to trade without completing full KYC verification. While KYC is required for higher withdrawal limits, users can still trade anonymously with limited withdrawal capabilities.

Pros:

- Supports over 700 cryptocurrencies

- No KYC required for spot trading and limited withdrawals

- High liquidity and low trading fees

- Features such as futures trading, staking, and lending

Cons:

- Withdrawals are limited for no-KYC accounts

- Subject to regulatory scrutiny due to centralized structure

- Customer support can be slow during high-demand periods

Expert Tip:

Use multiple wallets to manage funds efficiently and withdraw smaller amounts to stay within no-KYC limits.

3. TradeOgre

Best for: Privacy coin trading

TradeOgre is a no-frills, privacy-focused exchange that specializes in privacy coins like Monero (XMR) and Haven (XHV). It does not require KYC and prioritizes anonymous transactions.

Pros:

- Supports Monero (XMR) and other privacy-focused coins

- No personal information required

- Simple and easy-to-use interface

Cons:

- Limited customer support options

- Fewer trading pairs compared to major exchanges

- No fiat-to-crypto trading support

Expert Tip:

When trading privacy coins, always use a VPN and private wallet to enhance anonymity.

4. MEXC Global

Best for: High-leverage trading

MEXC Global is a top-tier exchange that allows anonymous trading for users who do not complete KYC verification. It supports a broad range of cryptocurrencies and offers up to 200x leverage on futures trading.

Pros:

- No KYC required for trading and withdrawals up to a certain limit

- Supports spot, futures, and margin trading

- Competitive trading fees

Cons:

- High leverage is risky, especially for beginners

- Limited fiat on-ramp options for no-KYC users

- Subject to regulatory restrictions in certain regions

Expert Tip:

Avoid using high leverage unless you are an experienced trader, as it increases the risk of liquidation.

5. Hodl Hodl

Best for: Bitcoin P2P trading with smart contracts

Hodl Hodl is a non-custodial P2P exchange that enables users to buy and sell Bitcoin without requiring KYC verification. It uses smart contracts to ensure secure transactions between buyers and sellers.

Pros:

- No KYC, no custody – users control their funds

- Smart contract-based escrow system for secure transactions

- Global availability

Cons:

- Only supports Bitcoin trading

- Lower liquidity compared to major exchanges

- Users need to find trustworthy trading partners

Expert Tip:

Always verify seller reputation before engaging in P2P trades to minimize the risk of scams.

Pros and Cons of No-KYC Exchanges

Pros:

✅ Anonymity & Privacy – Protects your identity from government tracking and data breaches.

✅ Quick Access – No need to go through lengthy verification processes.

✅ Lower Risk of Censorship – Less regulatory interference, allowing free access to trading.

✅ Greater Control – No third-party involvement in managing your funds.

Cons:

❌ Limited Fiat Options – Many no-KYC exchanges do not support fiat deposits or withdrawals.

❌ Lower Withdrawal Limits – Some platforms impose strict withdrawal limits for non-KYC users.

❌ Security Risks – Fewer regulatory protections mean a higher risk of hacks or scams.

❌ Restricted Access – Some exchanges block users from specific regions due to regulations.

Expert Tips for Using No-KYC Exchanges Safely

✔️ Use a VPN – Mask your IP address and location to enhance privacy. ✔️ Enable 2FA – Protect your account from unauthorized access. ✔️ Store Funds in Cold Wallets – Avoid keeping large amounts on exchanges. ✔️ Use Privacy Coins – Coins like Monero (XMR) enhance transaction anonymity. ✔️ Withdraw in Small Amounts – Stay under withdrawal limits to maintain KYC-free status.

Final Thoughts: Are No-KYC Exchanges Right for You?

No-KYC exchanges provide traders with unparalleled privacy and freedom, but they come with potential risks. If you value anonymity and control over your funds, platforms like Bisq, KuCoin, and TradeOgre are excellent choices. However, always weigh the risks and take security precautions before trading.

Want to learn how to trade crypto efficiently while keeping your identity safe? Get your copy of Crypto Made Easy today. This guide simplifies the best crypto trading strategies, security practices, and earning opportunities for all skill levels.

For more expert insights on cryptocurrency, privacy, and blockchain trends, visit OmaTreasure.com. Stay ahead of the game and make informed decisions in the ever-evolving world of crypto!

Avoid These 7 Crypto Trading Mistakes That Could Cost You Thousands

Cryptocurrency trading offers massive profit potential, but it also comes with risks. Many traders—especially beginners—fall into common traps that lead to significant financial losses. Whether you’re new to crypto or already investing, understanding these mistakes can save you thousands of dollars and help you make smarter trading decisions.

If you’re looking for a step-by-step guide to mastering crypto trading, my book Cryhttps://payhip.com/b/CKj5ihttps://payhip.com/b/CKj5ipto Made Easy simplifies the process, even for beginners. Grab your copy here or visit omatreasure.com for more valuable insights!

1. Ignoring Risk Management

One of the biggest mistakes traders make is failing to manage risk properly. Unlike traditional investments, crypto markets are highly volatile. Without a clear risk management strategy, a single bad trade could wipe out your portfolio.

How to Avoid This Mistake:

- Never invest more than you can afford to lose.

- Use stop-loss orders to limit potential losses.

- Diversify your portfolio instead of putting all your money into one coin.

- Follow the 1% rule: Never risk more than 1% of your total trading capital on a single trade.

2. Chasing Hype and FOMO (Fear of Missing Out)

Many traders buy coins simply because they see them trending on social media or in the news. This is a dangerous approach because by the time the public hears about a coin, early investors may already be taking profits, leaving latecomers to suffer losses.

How to Avoid This Mistake:

- Always do your own research (DYOR) before investing in any cryptocurrency.

- Analyze market trends and look for long-term value instead of short-term hype.

- Don’t rush into trades—opportunities come and go, but the key is to invest at the right time.

3. Overtrading

Overtrading happens when traders execute too many trades, often due to impatience or the desire to recover losses quickly. This leads to unnecessary risks, higher transaction fees, and emotional decision-making.

How to Avoid This Mistake:

- Stick to a well-thought-out trading plan instead of making impulsive trades.

- Take a break after a series of losses to clear your mind and avoid revenge trading.

- Focus on quality trades rather than quantity.

4. Not Understanding Market Trends and Patterns

Trading without understanding market trends is like driving without a map—you may eventually get somewhere, but it will be a costly and frustrating journey. Many traders buy and sell based on emotions rather than market analysis.

How to Avoid This Mistake:

- Learn how to read technical charts and identify support and resistance levels.

- Study indicators like RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and moving averages.

- Follow expert analysis and trading strategies rather than making random decisions.

5. Holding Onto Losing Trades for Too Long

Many traders refuse to accept losses and hold onto bad investments, hoping the price will recover. This often leads to bigger losses over time.

How to Avoid This Mistake:

- Set clear exit strategies before entering a trade.

- Use stop-loss orders to limit potential losses.

- Accept that losing trades are part of the game—cutting losses early is better than watching your portfolio shrink.

6. Trading Without a Strategy

A successful trader always follows a clear strategy rather than relying on luck. Many beginners jump into trading without a plan, leading to inconsistent results and losses.

How to Avoid This Mistake:

- Define a clear entry and exit strategy before placing trades.

- Use a journal to track your trades and learn from past mistakes.

- Stick to proven strategies like swing trading, day trading, or long-term investing.

7. Ignoring Security Best Practices

Crypto exchanges and wallets are prime targets for hackers. If you don’t take security seriously, you could lose your funds to theft.

How to Avoid This Mistake:

- Use two-factor authentication (2FA) on all trading accounts.

- Never share your private keys or passwords with anyone.

- Store a portion of your crypto in cold wallets (offline storage) instead of leaving everything on an exchange.

- Be cautious of phishing scams and fraudulent investment schemes.

Final Thoughts: Trade Smarter, Not Harder

Avoiding these seven mistakes will put you ahead of most traders who lose money due to emotional decisions and lack of knowledge. The best traders learn from their mistakes and continuously improve their strategies.

If you’re serious about mastering crypto trading, my book Crypto Made Easy breaks down everything you need to know in a simple, easy-to-understand format.

👉 Get your copy today at this link and visit omatreasure.com for more expert insights!

Remember, crypto trading is a marathon, not a sprint. Stay informed, trade wisely, and protect your investments!

10 MYTHS ABOUT CRYPTO YOU NEED TO STOP BELIEVING

Cryptocurrency has taken the world by storm, transforming how we think about money and investment. Yet, despite its growing popularity, many myths still surround this digital innovation. Let’s debunk the top ten misconceptions about cryptocurrency and set the record straight.

1. Cryptocurrency Is Only Used for Illegal Activities

One of the oldest myths about cryptocurrency is its association with criminal activities. While Bitcoin initially gained notoriety on dark web markets, studies have shown that only a tiny fraction of crypto transactions are linked to illicit purposes. Blockchain technology, which underpins cryptocurrencies, is highly transparent, making it easier for authorities to track illegal activities.

2. Cryptocurrency Has No Real-World Value

Many critics claim that cryptocurrencies are worthless because they lack physical form or government backing. However, cryptocurrencies derive value from their utility, scarcity, and demand. For instance, Bitcoin’s capped supply and increasing adoption as a store of value contribute to its worth.

3. Cryptocurrencies Are a Fad

Skeptics often dismiss cryptocurrencies as a passing trend. However, blockchain technology has already proven its potential in revolutionizing industries beyond finance, such as healthcare, supply chain, and gaming. Major companies and governments are also exploring blockchain solutions, solidifying crypto’s place in the future economy.

4. You Must Buy a Whole Bitcoin

Many people think they need thousands of dollars to invest in Bitcoin. In reality, cryptocurrencies are divisible into smaller units. For Bitcoin, the smallest unit is a satoshi, which equals 0.00000001 BTC. This makes cryptocurrency accessible to investors with any budget.

5. Cryptocurrency Is Completely Anonymous

While cryptocurrencies offer privacy, they are not entirely anonymous. Blockchain transactions are recorded on a public ledger, making them traceable. Some cryptocurrencies, like Monero and Zcash, provide enhanced privacy features, but they’re the exception rather than the rule.

6. Cryptocurrency Is Not Secure

Another myth is that cryptocurrency is inherently insecure. While crypto exchanges and wallets can be hacked, blockchain technology itself is highly secure due to its decentralized and cryptographic nature. Using secure wallets and following best practices can significantly reduce risks.

7. Cryptocurrency Mining Is Easy Money

Mining might seem like a quick way to make money, but it’s far from easy. It requires significant upfront investment in hardware, a cheap and stable electricity supply, and technical expertise. For most individuals, mining isn’t as profitable as it seems.

8. All Cryptocurrencies Are the Same

It’s a mistake to lump all cryptocurrencies together. Each has unique features and use cases. For instance, Bitcoin serves as a digital gold, while Ethereum enables decentralized applications through its smart contract functionality. Researching each cryptocurrency’s purpose is crucial before investing.

9. Cryptocurrency Guarantees Quick Riches

While some investors have made substantial profits, cryptocurrencies are highly volatile and risky. Prices can surge or plummet within hours. A sound investment strategy and thorough research are essential to navigate the market successfully.

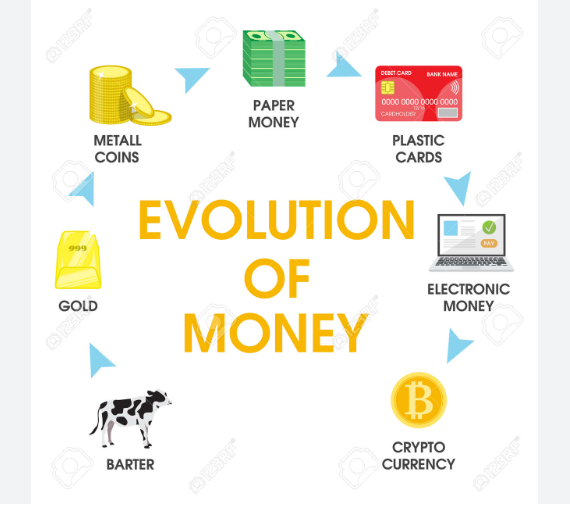

10. Cryptocurrency Will Replace Fiat Money Soon

While cryptocurrencies offer an alternative to traditional currencies, they are unlikely to replace fiat money in the near future. Governments and central banks still control traditional financial systems, and crypto adoption faces regulatory and infrastructural challenges.

Final Thoughts

Cryptocurrencies are a groundbreaking innovation, but misinformation can cloud their true potential. By understanding the facts, you can make informed decisions and navigate the crypto world confidently. Whether you’re a beginner or an enthusiast, staying updated on cryptocurrency developments is crucial.

Don’t miss out on more insights and updates! Visit OMATREASURE.COM regularly to stay informed about the latest in cryptocurrency and blockchain technology. Let’s empower your journey toward financial freedom!

TOP 5 REASONS WHY CRYPTO WILL SHAPE THE FUTURE OF MONEY

The world of finance is undergoing a revolutionary transformation, and cryptocurrency is at the forefront of this change. By leveraging blockchain technology, cryptocurrencies offer an innovative approach to money, reshaping traditional systems and paving the way for a decentralized financial future. Let’s explore the top five reasons why crypto will undoubtedly shape the future of money.

1. Decentralization Ensures Greater Financial Freedom

Traditional financial systems rely heavily on centralized institutions like banks and governments. These intermediaries control access to money, often imposing fees, delays, and restrictions. Cryptocurrencies, on the other hand, operate on decentralized networks. This means no single entity controls the system, allowing individuals to transact freely without barriers.

For example, Bitcoin enables peer-to-peer transactions, eliminating the need for banks. This decentralized nature empowers users, especially in regions where access to financial services is limited or restricted. By breaking down these barriers, cryptocurrency is democratizing finance on a global scale.

2. Lower Transaction Costs and Faster Payments

Traditional cross-border payments frequently involve high fees and lengthy processing times. Cryptocurrencies solve this problem by enabling near-instant transactions at minimal costs. Blockchain technology ensures that payments are secure, transparent, and efficient.

For instance, sending money internationally through Bitcoin or stablecoins like USDT takes minutes, unlike conventional bank transfers, which can take days. These cost and time savings make cryptocurrencies a preferred choice for remittances and global commerce.

3. Enhanced Security and Transparency

The rise in cybercrime and fraud has exposed vulnerabilities in traditional financial systems. Cryptocurrencies offer enhanced security through cryptographic protocols and blockchain technology. Each transaction is recorded on a public ledger, making it nearly impossible to alter or manipulate.

Moreover, smart contracts—self-executing agreements on platforms like Ethereum—ensure transparency and reduce the risk of disputes. This combination of security and transparency builds trust among users, further solidifying crypto’s role in the future of money.

4. Empowering the Unbanked and Underbanked

Approximately 1.4 billion people worldwide lack access to banking services. Cryptocurrencies provide a viable solution to this problem. With just a smartphone and internet connection, anyone can create a digital wallet and participate in the global economy.

Platforms like Binance and Coinbase are making it easier for individuals to buy, sell, and hold cryptocurrencies. By providing financial inclusion, crypto is bridging the gap for the unbanked and underbanked populations, unlocking new economic opportunities.

5. Innovation in Digital Finance

The crypto ecosystem is a hub of innovation. From decentralized finance (DeFi) to non-fungible tokens (NFTs) and beyond, cryptocurrencies are redefining how we interact with money and digital assets. DeFi platforms enable lending, borrowing, and earning interest without intermediaries, while NFTs are revolutionizing ownership in art, gaming, and real estate.

These advancements highlight the versatility and potential of cryptocurrencies to transform various industries. As new use cases emerge, the adoption of crypto will continue to grow, solidifying its place in the future of money.

Conclusion: Embrace the Future with Crypto

Cryptocurrencies are not just a trend; they represent a paradigm shift in how we perceive and use money. By offering decentralization, lower costs, enhanced security, financial inclusion, and continuous innovation, crypto is shaping the future of finance. Don’t miss out on the opportunities this transformation presents.

Ready to explore more about the exciting world of cryptocurrency? Stay connected to our website for insightful updates, guides, and the latest trends. Bookmark us and return often to stay ahead in this rapidly evolving space!

Unlocking the World of Cryptocurrency

Welcome to Omatreasure! We are your trusted source for all things crypto. Our team of seasoned enthusiasts and financial experts bring you daily news, in-depth tutorials, expert opinions, and insightful investment guides. Explore our content and embark on a journey through the exciting world of cryptocurrency.

Unlocking Crypto Insights

Explore the dynamic world of Omatreasure, where expert insights and crypto trends converge.

Navigating Crypto Markets

Crypto Universe

Experience the pulse of the crypto world with our in-depth analyses.

The Crypto Landscape

Decoding Digital Assets

Dive into the world of cryptocurrency and blockchain with insightful articles and guides.

Trends that Shape Crypto

A Dive into Crypto

Discover the vibrant world of crypto with comprehensive guides and expert analysis.

Connect with Omatreasure

Have questions or want to discuss a project? Reach out to us anytime. We’re here to assist!