Top 5 Cryptocurrencies to Buy in April 2025 for Maximum Profits & Growth!

With the cryptocurrency market evolving rapidly, April 2025 presents exciting investment opportunities for those looking to maximize their returns. Expert analysts suggest that selecting the right cryptocurrencies now could yield significant gains as market trends shift. In this article, we explore the top five cryptocurrencies with strong fundamentals, growth potential, and strategic advantages for investors this month.

1. Bitcoin (BTC) – The Safe Haven Asset

Bitcoin remains the undisputed top leader in the cryptocurrency space. As institutional adoption continues to rise, Bitcoin’s scarcity and dominance make it a must-have in any investment portfolio. The recent approval of Bitcoin ETFs, increased corporate adoption, and growing mainstream acceptance are strong indicators of its long-term value.

Why Invest in Bitcoin?

- Acts as a hedge against inflation.

- Increasing institutional adoption by companies like BlackRock and Fidelity.

- Bitcoin’s halving event in 2024 continues to impact supply, driving price appreciation.

2. Ethereum (ETH) – The Backbone of Web3

Ethereum has solidified its position as the backbone of decentralized applications (DApps), smart contracts, and DeFi (Decentralized Finance). The successful implementation of Ethereum 2.0, with its shift to a proof-of-stake consensus, has improved scalability, security, and energy efficiency.

Why Invest in Ethereum?

- Largest smart contract platform with thousands of active developers.

- Growing NFT and metaverse adoption.

- Enhanced staking rewards after the Ethereum upgrade.

3. Solana (SOL) – The High-Speed Contender

Solana has emerged as one of the fastest blockchain networks, providing ultra-low transaction costs and high-speed processing. Despite facing network outages in the past, Solana has improved its infrastructure, attracting major projects in DeFi and NFT markets.

Why Invest in Solana?

- Lightning-fast transactions at a fraction of Ethereum’s gas fees.

- Rapidly growing developer and community adoption.

- Increasing number of real-world applications and partnerships.

4. Polkadot (DOT) – The Future of Interoperability

Polkadot is designed to connect multiple blockchains, allowing seamless communication between different crypto ecosystems. With its unique parachain technology, Polkadot enables projects to launch their own customized blockchains while benefiting from Polkadot’s security.

Why Invest in Polkadot?

- Growing adoption in cross-chain solutions.

- Strong developer ecosystem backing innovative projects.

- Increased staking opportunities for passive income.

5. Chainlink (LINK) – The Power of Oracle Networks

Chainlink is a crucial component of the decentralized economy, providing smart contracts with real-world data. As blockchain adoption increases in industries like finance, gaming, and supply chain management, Chainlink’s oracle solutions become even more vital.

Why Invest in Chainlink?

- High demand for accurate, secure data feeds in smart contracts.

- Integration with major DeFi platforms and real-world applications.

- Strong partnerships with tech giants like Google and Oracle.

Final Thoughts – Invest Wisely in April 2025

As the crypto market matures, selecting the right investments requires thorough research, patience, and an understanding of emerging trends. Bitcoin and Ethereum remain strong long-term bets, while Solana, Polkadot, and Chainlink present exciting growth opportunities. Whether you’re an experienced investor or just starting your crypto journey, staying informed is key to maximizing your returns.

Want to Master Crypto Investing? Read “Crypto Made Easy“

If you’re serious about navigating the crypto world with confidence, my book, “Crypto Made Easy: Best Beginner’s Guide to Making Money in Crypto from Scratch,” is the perfect resource. This comprehensive guide simplifies complex topics, from market trends to investment strategies, helping you build wealth in the digital asset space.

Don’t miss out on the next big opportunity—get your copy today and take control of your financial future!

RIPPLE VS. SEC A COMPREHENSIVE UPDATE ON THE LANDMARK LEGAL BATTLE

This prolonged legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has reached a pivotal conclusion, marking a significant milestone for the cryptocurrency industry. After more than four years of litigation, the SEC has officially dropped its lawsuit against Ripple, leading to notable developments for both the company and its native cryptocurrency, XRP.

Background of the Lawsuit

In December 2020, the SEC filed a lawsuit against Ripple Labs, alleging that the company conducted an unregistered securities offering by selling XRP tokens, raising approximately $1.3 billion. The SEC’s contention was that XRP should be classified as a security, subjecting it to stringent regulatory oversight. Ripple consistently refuted these claims, arguing that XRP functions as a currency and should not be categorized as a security.

Resolution and Settlement Details

In a significant turn of events, Ripple Labs announced that the SEC has agreed to drop its appeal against the company. As part of the settlement, Ripple consented to pay a reduced fine of $50 million, a substantial decrease from the initially imposed $125 million. This settlement is said to be pending approval from both the SEC and the presiding judge. However, Ripple did not admit to any wrongdoing as part of the agreement.

The Implications for XRP and the Crypto Market

The dismissal of the lawsuit has had an immediate positive impact on XRP’s market performance. Following the announcement, XRP’s price experienced a notable surge, reflecting renewed investor confidence. This development also signals a potential shift in the regulatory landscape for cryptocurrencies in the United States, suggesting a more accommodating approach towards digital assets.

Broader Regulatory Context

The resolution of the Ripple case aligns with a series of regulatory adjustments under President Donald Trump’s administration. The current administration has demonstrated a more favorable stance towards the cryptocurrency industry, including the establishment of a crypto task force aimed at fostering innovation and providing clearer regulatory guidelines. These actions contrast with the previous administration’s approach, which advocated for stricter regulations on digital assets.

Expert Insights and Future Outlook

Legal experts anticipate that the complete resolution of the Ripple lawsuit will occur within the next two months. The process involves drafting final documents, obtaining necessary approvals, and lifting existing injunctions. This expedited timeline reflects the commitment of both parties to conclude the matter efficiently.

The outcome of this case sets a precedent for how cryptocurrencies are classified and regulated in the United States. It underscores the necessity for clear and consistent regulatory frameworks that balance investor protection with the promotion of technological innovation. Market participants are optimistic that this resolution will pave the way for increased adoption and integration of cryptocurrencies into mainstream financial systems.

In Conclusion

The conclusion of the SEC’s lawsuit against Ripple Labs represents a landmark moment for the cryptocurrency industry. It alleviates a significant source of uncertainty and opens the door for more constructive engagement between regulators and crypto enterprises. As the industry continues to evolve, ongoing dialogue and collaboration will be essential in shaping a regulatory environment that supports growth while safeguarding market integrity.

This Week in Crypto: Must-Know Trends, Predictions & Smart Strategies

The cryptocurrency market is ever-evolving, influenced by global economic factors, regulatory shifts, and investor sentiment. Staying informed about market trends, price movements, and strategic investment opportunities is crucial for traders and long-term investors. This article provides in-depth insights into the latest crypto market trends, weekly predictions, and proven strategies to maximize profits in April 2025.

Current Market Trends & Insights

1. Bitcoin’s Post-Halving Momentum Continues

Bitcoin (BTC) remains the dominant force in the crypto market. Following the 2024 halving event, BTC has seen reduced supply, driving price increases. Institutional investors continue to show interest, with major firms integrating Bitcoin into their portfolios.

Key Takeaways:

- Bitcoin ETF adoption is accelerating institutional investment.

- Reduced BTC supply post-halving could push prices higher.

- Analysts predict Bitcoin could test the $100,000 mark in Q2 2025.

2. Ethereum’s Network Expansion and DeFi Growth

Ethereum (ETH) has strengthened its position as the leading smart contract platform. With Ethereum 2.0 upgrades optimizing scalability and transaction speeds, its adoption in DeFi and NFT markets is on the rise.

Key Takeaways:

- Layer 2 solutions (e.g., Arbitrum, Optimism) are making Ethereum transactions faster and cheaper.

- Institutional staking participation is increasing ETH’s long-term value.

- Price forecasts suggest Ethereum could surpass $5,000 if market conditions remain bullish.

3. Altcoin Season: Rising Stars to Watch

April 2025 is seeing renewed interest in altcoins, with several emerging as strong investment candidates.

- Solana (SOL): Continues to dominate in gaming and NFT sectors with its high-speed transactions.

- Polkadot (DOT): Gains traction as an interoperability leader, facilitating seamless cross-chain transactions.

- Chainlink (LINK): Expands its oracle network, bridging blockchain with real-world data, essential for DeFi growth.

4. AI & Blockchain Integration on the Rise

The fusion of artificial intelligence (AI) and blockchain is a growing trend, with AI-driven projects leveraging decentralized networks for enhanced security and efficiency.

Key Takeaways:

- AI-powered trading bots are optimizing market predictions.

- Decentralized AI platforms are gaining traction in finance and cybersecurity.

- Investors are diversifying into AI-integrated crypto projects.

5. Stablecoin Regulation and Market Impact

Regulators worldwide are tightening their grip on stablecoins, aiming to ensure financial stability. This has impacted liquidity flow in the crypto ecosystem.

Key Takeaways:

- US and EU regulatory frameworks may reshape stablecoin utility.

- Increased transparency could drive mainstream adoption.

- Investors are diversifying into decentralized stablecoins as an alternative.

Crypto Market Predictions for April 2025

Based on expert insights and market analysis, here are key predictions for this month:

- Bitcoin: Expected to hover between $90,000 and $110,000 as demand outpaces supply.

- Ethereum: Anticipated to surge above $5,000, fueled by DeFi growth and network upgrades.

- Altcoins: Select tokens (SOL, DOT, LINK) could experience a 20-40% price increase.

- Regulatory Developments: More clarity on global crypto regulations may lead to increased institutional investments.

Winning Strategies for Crypto Investors

1. Diversify Your Portfolio

Holding a balanced mix of Bitcoin, Ethereum, and high-potential altcoins can mitigate risk and optimize returns.

2. Utilize Dollar-Cost Averaging (DCA)

Investing a fixed amount regularly reduces exposure to market volatility and allows accumulation at different price levels.

3. Engage in Staking & Yield Farming

Maximize passive income by staking ETH, DOT, and LINK or participating in liquidity pools.

4. Stay Updated with Market News

Following daily and weekly crypto insights ensures timely investment decisions. Platforms like OMATREASURE.COM provide expert analysis to help navigate market fluctuations.

5. Secure Your Investments

Use hardware wallets and implement multi-factor authentication to protect digital assets from cyber threats.

Want to Master Crypto Investing? Read “Crypto Made Easy“

Navigating the cryptocurrency market can be complex, but with the right knowledge, anyone can succeed. My book, “Crypto Made Easy: Best Beginner’s Guide to Making Money in Crypto from Scratch,” simplifies crypto investing, trading strategies, and market analysis for beginners and experienced traders alike.

For real-time updates and expert insights, visit OMATREASURE.COM, your trusted source for crypto market news and investment strategies.

Don’t miss out—grab your copy of ‘Crypto Made Easy’ today and take charge of your financial future!

Analysis of Kaito Coin:

The Rising Star in AI-Driven Cryptocurrencies; Deep dive into the fundamentals of Kaito Coin.

The cryptocurrency market is no stranger to innovation, and Kaito Coin is one of the latest projects to capture the attention of investors and tech enthusiasts alike. Positioned at the intersection of artificial intelligence (AI) and blockchain technology, Kaito Coin aims to revolutionize how we interact with decentralized systems by leveraging the power of AI. In this analysis, we’ll explore the fundamentals of Kaito Coin, its unique value proposition, tokenomics, and potential for growth in the rapidly evolving crypto space.

What is Kaito Coin?

Kaito Coin is the native cryptocurrency of the Kaito AI ecosystem, a decentralized platform that integrates advanced AI algorithms with blockchain technology. The project’s mission is to create a smarter, more efficient, and user-friendly blockchain ecosystem by harnessing the capabilities of AI. Kaito Coin serves as the backbone of this ecosystem, enabling transactions, incentivizing network participation, and facilitating governance.

The Kaito AI ecosystem is designed to address some of the most pressing challenges in the blockchain space, including scalability, security, and usability. By combining AI with blockchain, Kaito aims to deliver a next-generation platform that empowers users and developers alike.

Key Features of Kaito Coin

1. AI-Driven Blockchain Solutions:

Kaito Coin leverages AI to optimize various aspects of blockchain technology, including transaction processing, network security, and data analysis. This integration allows the platform to operate more efficiently and intelligently than traditional blockchain networks.

2. Decentralized AI Marketplace:

One of the standout features of the Kaito ecosystem is its decentralized AI marketplace. Here, developers can create, share, and monetize AI models and algorithms, while users can access these tools to enhance their blockchain experience. Kaito Coin is used as the primary medium of exchange within this marketplace.

3. Enhanced Security:

Kaito’s AI algorithms are designed to detect and prevent security threats in real-time, making the network more resilient to attacks. This proactive approach to security sets Kaito apart from many other blockchain projects.

4. Scalability:

By using AI to optimize resource allocation and transaction processing, Kaito Coin ensures that the network can scale to meet growing demand without compromising on speed or efficiency.

5. User-Friendly Interface:

Kaito’s platform is designed with usability in mind. Its intuitive interface makes it easy for both beginners and experienced users to interact with the ecosystem, fostering broader adoption.

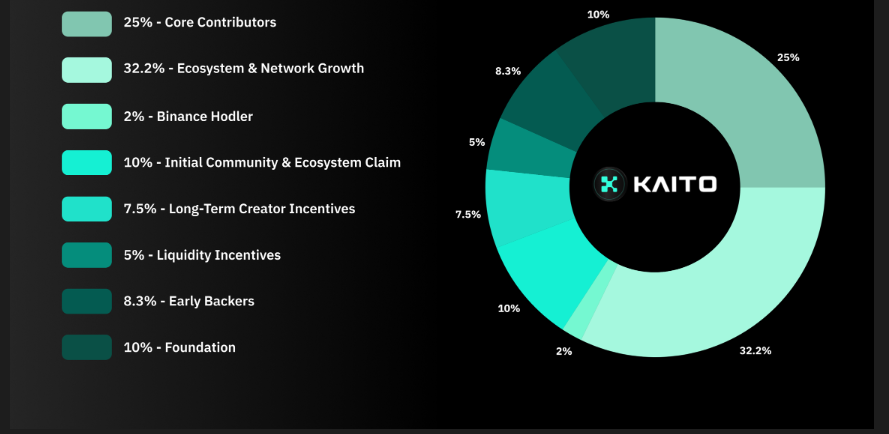

Tokenomics of Kaito Coin

The success of any cryptocurrency project depends on its tokenomics. Here’s a breakdown of Kaito Coin’s tokenomics:

Total Supply:

The total supply of Kaito Coin is capped at [insert total supply if available], ensuring scarcity and long-term value appreciation.

Distribution:

Kaito Coin’s distribution is designed to promote fairness and decentralization. A significant portion of the tokens is allocated to community incentives, ecosystem development, and decentralized governance.

Use Cases:

Transaction Fees: Kaito Coin is used to pay for transaction fees on the Kaito network.

Staking: Users can stake Kaito Coin to secure the network and earn rewards.

Governance: Kaito Coin holders can participate in governance decisions, shaping the future of the ecosystem.

AI Marketplace: Kaito Coin is the primary currency for transactions within the decentralized AI marketplace.

Potential Use Cases

Kaito Coin’s utility extends beyond the Kaito ecosystem. Here are some potential use cases:

1. Decentralized Finance (DeFi):

Kaito’s AI-driven platform can enhance DeFi applications by optimizing transaction processing, improving risk assessment, and providing real-time analytics.

2. Data Analysis:

Businesses and researchers can use Kaito’s AI tools to analyze large datasets, uncovering insights that would be difficult or impossible to obtain using traditional methods.

3. Cybersecurity:

Kaito’s AI algorithms can be used to detect and prevent cyber threats, making it a valuable tool for organizations looking to enhance their security posture.

4. Gaming:

The gaming industry can benefit from Kaito’s AI-driven platform, which can optimize in-game transactions, enhance user experiences, and provide real-time analytics.

5. Healthcare:

Kaito’s AI tools can be used to analyze medical data, improving diagnostics and treatment outcomes.

Competitive Advantage

Kaito Coin stands out in the crowded crypto market due to its unique combination of AI and blockchain technology. Here are some of its key competitive advantages:

AI Integration: Kaito’s use of AI sets it apart from traditional blockchain projects, enabling smarter and more efficient operations.

Decentralized AI Marketplace: The platform’s AI marketplace provides a unique opportunity for developers and users to collaborate and innovate.

Enhanced Security: Kaito’s proactive approach to security makes it a more resilient and trustworthy platform.

Scalability: By optimizing resource allocation and transaction processing, Kaito ensures that its network can scale to meet growing demand.

Risks and Challenges

While Kaito Coin has immense potential, it’s important to consider the risks and challenges:

1. Competition: The crypto market is highly competitive, with numerous projects vying for market share. Kaito will need to differentiate itself to stand out.

2. Adoption: The success of Kaito depends on widespread adoption by developers and users. Convincing the crypto community to embrace AI-driven solutions could be a challenge.

3. Regulatory Uncertainty: Like all cryptocurrencies, Kaito Coin is subject to regulatory risks. Changes in regulations could impact its growth and adoption.

Future Outlook

The future looks bright for Kaito Coin. As the demand for AI-driven solutions continues to grow, Kaito is well-positioned to become a major player in the crypto space. With its innovative technology, strong community focus, and real-world use cases, Kaito Coin has the potential to revolutionize the blockchain industry.

Investors and developers should keep a close eye on Kaito as it rolls out new features, partnerships, and ecosystem developments. The project’s success will depend on its ability to execute its vision and attract a critical mass of users and developers.

Conclusion

Kaito Coin represents a promising addition to the crypto market, offering a unique blend of AI and blockchain technology. Its innovative approach to scalability, security, and usability makes it a project worth watching.

For investors, Kaito Coin offers an opportunity to get in early on a project with significant growth potential. For developers, it provides a powerful platform to build smarter and more efficient decentralized applications. As the crypto world continues to evolve, Kaito Coin is poised to play a key role in shaping the future of blockchain technology.

*Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Cryptocurrency investments are highly volatile and also risky. Always carry out your own research before investing.*

TOP 5 ALTCOINS UNDER $0.10 WITH 25X TO 200X POTENTIAL

Investors seeking opportunities in the cryptocurrency market may find value in altcoins priced under $0.10. These tokens, though inexpensive, exhibit strong potential for significant returns ranging from 25x to 200x. Below are five notable options to watch:

- CYBRO (CBRO): Designed as the utility token for CYBRO NeoBank, this digital asset powers decentralized finance (DeFi) services like yield farming and cashback rewards. With a presale that garnered significant interest and funding exceeding $2.5 million, CYBRO aims to enhance user engagement through staking incentives and reduced fees. Analysts anticipate robust performance as the platform expands its user base.

- Kaspa (KAS): Known for leveraging the GHOSTDAG protocol, Kaspa represents innovation in blockchain technology. Unlike traditional chains, Kaspa enables faster transaction speeds and greater scalability without sacrificing decentralization. This focus on improving network efficiency positions it well for adoption in high-demand applications.

- Shiba Inu (SHIB): Originally popularized as a meme coin, SHIB has evolved with practical utilities, including the ShibaSwap decentralized exchange. Backed by a strong community and strategic ecosystem developments, SHIB continues to attract attention from both retail and institutional investors. Its versatility could drive substantial growth during future market uptrends.

- VeChain (VET): This blockchain project focuses on supply chain optimization by integrating transparency and traceability into logistics. By collaborating with major corporations like BMW and Walmart China, VeChain demonstrates real-world use cases that strengthen its value proposition.

- BLASTUP: Emerging as a promising token from the Blast platform, BLASTUP facilitates launchpad services and incentivizes users through high staking rewards. With rapid adoption and price appreciation post-launch, it holds potential for significant upward movement as the platform matures.

Investing in such altcoins requires careful analysis of their utility, development roadmap, and market trends. Diversification and strategic risk management are essential for maximizing returns in the volatile cryptocurrency space.

If you need further details or links to explore these tokens, let me know in the comment section.

Contact Omatreasure

Reach out for inquiries or collaborations. We look forward to connecting!